POSTRETIREMENT HEALTHCARE AND INSURANCE COSTS

Most large companies cover a portion of the healthcare and insurance costs incurred by employees after retirement. Similar to pensions, such coverage is part of employee compensation and is earned over an employee's years of service. According to the matching principle, therefore, such costs should be accrued over the employee's tenure with the company, and then the associated liability should be written off as the benefits are paid after the employee's retirement. The issues of estimating this liability, providing adequate funds to meet required future payments, and accounting for such transactions are very similar to those involved with pensions, and accordingly, the appropriate accounting methods are basically the same.

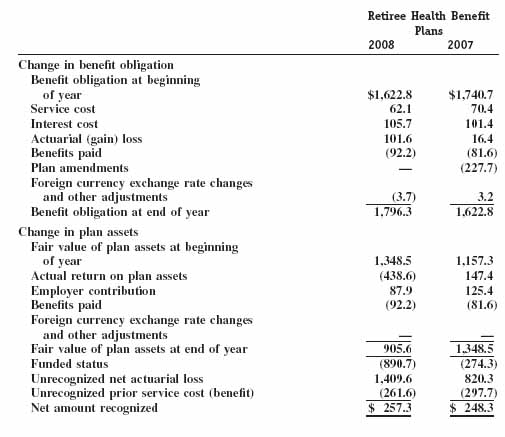

The following excerpt comes from the 2008 annual report of Eli Lilly which, like many other companies, provides the same disclosures for postretirement healthcare costs as they do for pensions (dollars in millions).

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.