REVIEW PROBLEM

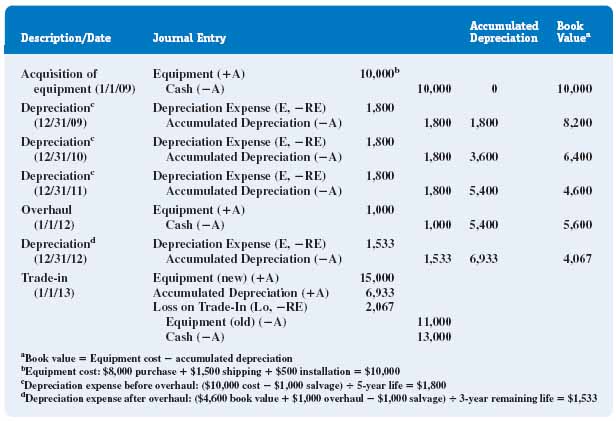

Norby Enterprises purchased equipment on January 1, 2009, for $8,000. It cost $1,500 to have the equipment shipped to the plant and $500 to have it installed. The equipment was estimated to have a five-year useful life and a salvage value of $1,000. On January 1, 2012, the equipment was overhauled at a cost of $1,000, and the overhaul extended its estimated useful life by an additional year (from five to six years). On January 1, 2013 the equipment and $13,000 cash were traded for a dissimilar piece of equipment with a FMV of $15,000. Norby uses the straight-line method of depreciation. The computations and journal entries related to the acquisition, depreciation, overhaul, and disposal of the equipment appear in Figure 9-18.

FIGURE 9-18 Solution to review problem: Norby Enterprises

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.