REVIEW PROBLEM II

Trailor Corporation entered into the two transactions listed below on January 1, 2011.

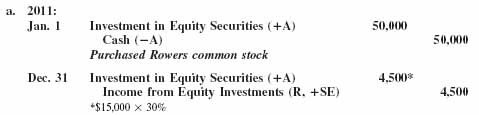

a. On January 1, 2011, Trailor purchased 30 percent of the outstanding common stock of Rowers Company for $50,000. Income reported by Rowers during 2011 and 2012 was $15,000 and $8,000, respectively. Rowers declared and paid dividends to Trailor in the amount of $3,000 during each of the two years.

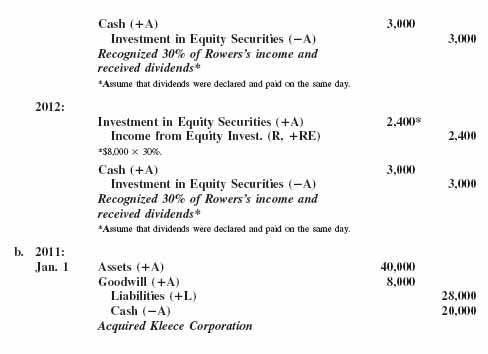

b. On January 1, 2011, Trailor purchased 100 percent of the outstanding common stock of Kleece Corporation for $20,000. The FMVs of the individual assets and liabilities of Kleece Corporation, as of the time of the acquisition, were $40,000 and $28,000, respectively.

The related journal entries that would be recorded for each transaction over the subsequent two-year period follow.

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.