REVIEW PROBLEM I

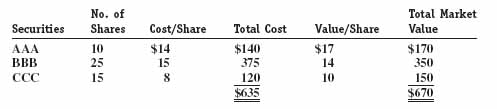

The following information relates to the marketable security investments of Macon Construction. Securities held on December 31, 2011, are described in the table on next page. AAA and BBB are classified as trading securities, and CCC is classified as an available-for-sale security.

Early in 2012, Macon sold all of its investment in AAA securities for $18 per share. The company also sold five shares of BBB for $13 per share. During 2012, Macon received dividends of $3 per share on the remaining twenty shares of BBB, and dividends of $2 per share were declared, but not yet received, on the 15 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2012, were $12 and $9, respectively. During 2013, Macon sold the remaining 20 shares of BBB stock for $13 per share and the 15 shares of CCC for $11 per share.

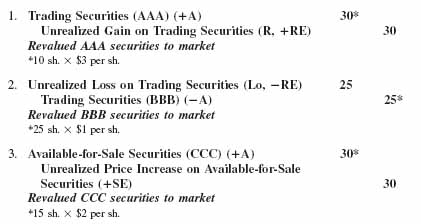

The journal entries that would be required for 2011 under the mark-to-market rule follow.

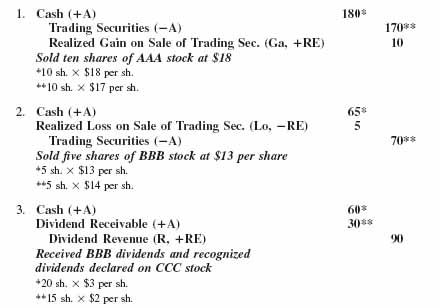

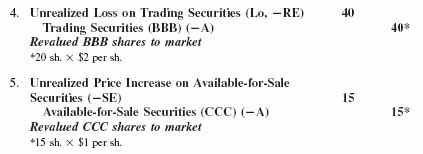

The journal entries that reflect 2012 activities involving short-term equity investments follow.

The journal entries that reflect the sales of short-term ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.