ISSUES FOR DISCUSSION

REAL DATA

ID7-1

Choosing FIFO or LIFO

A partner from a major accounting firm made the following comment when asked about the accounting methods used by companies in the software industry: “Accounting policies that have adverse short-term effects on financial statements cannot help the industry raise capital.”

After reading such a comment, one might conclude that managers who wish to raise capital by borrowing from banks or issuing equity or debt securities should choose the FIFO cost flow assumption instead of LIFO. Yet, others have written that they are “puzzled” about why thousands of U.S. companies use FIFO instead of LIFO.

REQUIRED:

Discuss the above comments.

REAL DATA

ID7-2

LIFO reporting

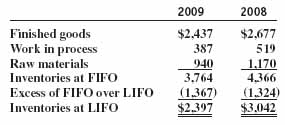

The following information was taken from the inventory footnote contained in the 2009 annual report of Deere & Company, the agricultural equipment manufacturer.

Most inventories owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the last-in, first-out (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the first-in, first-out (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 59 percent and 64 percent of worldwide gross inventories at FIFO value on October 31, 2009 and 2008, respectively.

REQUIRED:

a. Why would a potential investor or creditor who is considering investing ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.