PROBLEMS

P7-1

Purchases and cash discounts

On November 15 and 26, Brown and Swazey purchased merchandise on account for gross prices of $8,000 and $12,000, respectively. Terms of both purchases were 2/10, n/30. None of these items has been sold, and both accounts are paid in full on December 2.

REQUIRED:

Provide all the journal entries that would be recorded for these events.

P7-2

The gross method and partial payments

Stober Corporation made two purchases of inventory on account during the month of March. The first purchase was made on March 5 for $30,000, and the second purchase was made on March 10 for $60,000. The terms of each purchase were 2/10, n/30. The first purchase was settled on March 13, and the second was settled on July 18.

REQUIRED:

a. Prepare all the necessary journal entries associated with these transactions.

b. Assume that with respect to the second purchase, the company settled two-thirds of the accounts payable balance on March 19 and settled the remaining balance on August 7. The first purchase was settled on March 13. Prepare all the necessary journal entries associated with the second purchase.

REAL DATA

P7-3

The financial effects of inventory errors

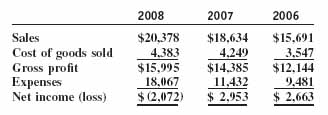

The following information was taken from the records of Eli Lilly, a major pharmaceutical (dollars in millions).

Assume that ending inventory was overstated by $500 in 2006, understated by $150 in 2007, and overstated ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.