BRIEF EXERCISES

REAL DATA

BE7-1

Inventory

In its 2008 annual report, Hewlett-Packard reported beginning inventory of $8.0 billion, ending inventory of $7.9 billion on the balance sheet, and cost of goods sold of $69.3 billion on the income statement. Compute the inventory purchases made by Hewlett-Packard during 2008.

REAL DATA

BE7-2

Inventory

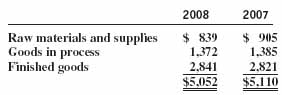

The following information was taken from the footnotes in the 2008 annual report of Johnson & Johnson.

a. From information in the footnote alone, indicate whether Johnson & Johnson is a retailer, manufacturer, or service firm. Explain.

b. From information in the footnote alone, indicate whether Johnson & Johnson uses the LIFO or FIFO inventory cost flow assumption. Explain. (Hint: What disclosures are required under LIFO? under FIFO?)

REAL DATA

BE7-3

FIFO vs. LIFO

General Electric uses the LIFO inventory cost flow assumption, reporting inventories on its 2008 balance sheet of $13.7 billion and a LIFO reserve of approximately $706 million. What would be GE's 2008 inventory balance if it used the FIFO assumption instead? Why is the disclosure of the LIFO reserve useful to financial statement users?

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.