PROJECTING FUTURE FINANCIAL STATEMENTS

A complete financial analysis includes an attempt to project future financial statements. These projections can be used in present value-based formulas that help to assess a company's market value, and they are often used internally by companies to establish budgets, standards that can be compared to actual results in the evaluation of management's performance. Used in this way, financial statement projections can motivate management to achieve higher levels of performance.

The process of projecting a future income statement and balance sheet involves the following steps.

- Predict future sales.

- Predict future profit margin.

- Based on the sales prediction, estimate the level of assets necessary to support that level of sales.

- Choose a target financing mix (liabilities vs. equity).

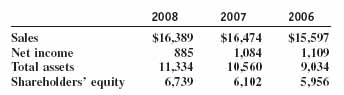

To illustrate how the process works, consider Kohl's Department Store, which reported the following dollar amounts (in millions) in 2008, 2007, and 2006.

PREDICT FUTURE SALES. Although in the time period 2006-2008 Kohl's grew only about 5 percent, over the past five years sales have grown at an average rate of about 10 percent. We assume 10 percent growth, leading to expected sales for 2009 of $18,028 ($16,389 × 1.1).

PREDICT FUTURE PROFIT MARGIN. Over the past three years net income/sales has been around 6 percent. We assume a 6 percent profit margin, leading to expected ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.