RECOGNIZING GAINS AND LOSSES

Companies often sell investments and noncurrent assets, receiving dollar amounts that do not match the amounts at which the investments are carried on the balance sheet. In such cases, a gain or loss must be recognized in the amount of the difference between the proceeds and the carrying amount.

![]() When JCPenney sold the Eckerd drugstore chain to CVS Corporation for $4.53 billion, it recorded a $77 million loss on the transaction. How can a company sell a subsidiary for over $4 billion and record a loss on the transaction?

When JCPenney sold the Eckerd drugstore chain to CVS Corporation for $4.53 billion, it recorded a $77 million loss on the transaction. How can a company sell a subsidiary for over $4 billion and record a loss on the transaction?

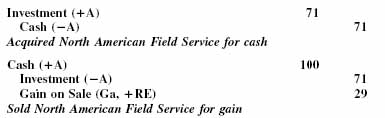

When McDonnell Douglas sold its North American Field Service business for $100 million, it recognized a $29 million gain because the investment was carried on the company's balance sheet at $71 million. Assuming that the business was acquired for $71 million, the following journal entries were used to record these events. (Dollar amounts are in millions.)

3. In actual accounting systems, the year-end balances in the revenue, expense, and dividend accounts are formally transferred to retained earnings through a series of journal entries. This closing process zeroes out the balances in the temporary accounts so that they begin at zero the next period. This process is illustrated in the review problem at the end of this chapter.

If McDonnell ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.