BRIEF EXERCISES

REAL DATA

BE2-1

Dividends as a percentage of net income

Revenues and expenses for PepsiCo during 2008 were $43.3 billion and $38.2 billion, respectively. The December 31, 2007 and 2008 balances in retained earnings were $28.2 billion and $30.6 billion, respectively. Compute dividends paid by PepsiCo during 2008. What percentage of net income did PepsiCo pay out in dividends during 2008?

REAL DATA

BE2-2

Financing assets

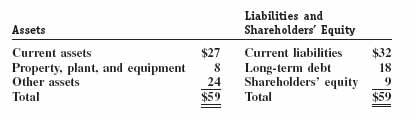

A summary of a recent balance sheet for Boeing Co. is as follows (dollars in billions):

What amount and what percentage of Boeing's assets were financed by (1) current liabilities, (2) long-term debt, and (3) shareholders' equity?

REAL DATA

BE2-2A

ssessing solvency

In BE2-2, Boeing's current assets consisted primarily of cash and short-term investments of $9.3 billion, accounts receivable of $5.7 billion, inventory of $9.6 billion, and miscellaneous current assets of $2.4 billion. Does the company appear solvent? Why or why not? Can Boeing pay off its current liabilities with liquid assets? Would it be more or less solvent if the dollar amounts in accounts receivable and inventory were reversed?

REAL DATA

BE2-4

The statement of cash flows across time

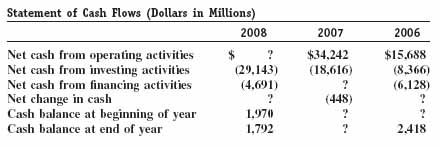

Excerpts from the annual report of AT&T, Inc., are as follows.

Compute the missing values and briefly ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.