CASE 6: PIERCE AND SNOWDEN

Pierce and Snowden is an established manufacturer of a wide variety of household items sold through retailers all over the United States. Wellington Mart and Wagner Stores, two retailers, have recently expressed an interest in carrying a number of Pierce and Snowden products. While these two potential customers could generate considerable volume for the company, both retailers would require the extension of a significant amount of credit, and in general, retail sales throughout the United States have been somewhat slow for several years.

You work in the finance department of Pierce and Snowden and have been asked to serve on a team whose task is to make a recommendation to management about whether, or how much, credit should be extended to Wellington Mart and Wagner Stores. The recommendation in part will be based on the solvency position and earning power of these two companies.

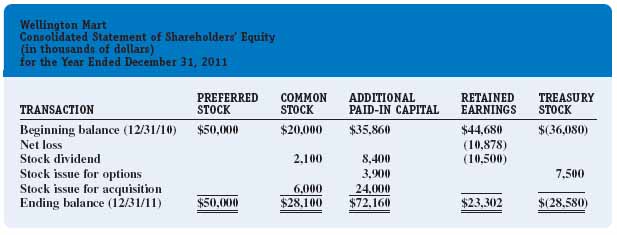

Your assignment is to analyze the financial statements of these two companies and—on that basis only—rate them on a scale from 1 to 10 (weak to strong) with respect to solvency position, earning power and persistence, and earnings quality. In addition to the ratings, provide a memo to the team captain stating why the ratings on these three dimensions do (or do not) differ between the two companies. The financial statements of Wellington Mart and Wagner Stores follow.

Footnotes ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.