| Chapter 7 | Fraud, Internal Control, and Cash |

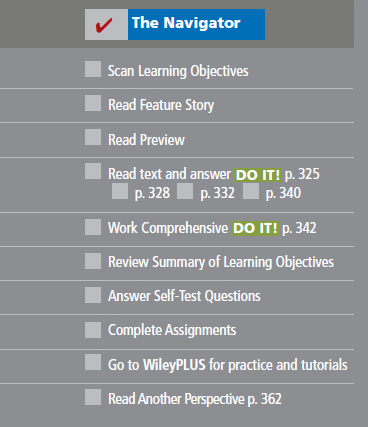

Learning Objectives

After studying this chapter, you should be able to:

1 Define fraud and internal control.

2 Identify the principles of internal control activities.

3 Explain the applications of internal control principles to cash receipts.

4 Explain the applications of internal control principles to cash disbursements.

5 Describe the operation of a petty cash fund.

6 Indicate the control features of a bank account.

7 Prepare a bank reconciliation.

8 Explain the reporting of cash.

![]()

Feature Story

Minding the Money in Moose Jaw

If you're ever looking for a cappuccino in Moose Jaw, Saskatchewan, Canada, stop by Stephanie's Gourmet Coffee and More (CAN), located on Main Street. Staff there serve, on average, 650 cups of coffee a day, including both regular and specialty coffees, not to mention soups, Italian sandwiches, and a wide assortment of gourmet cheesecakes.

“We've got high school students who come here, and students from the community college,” says owner/manager Stephanie Mintenko, who has run the place since opening it in 1995. “We have customers who are retired, and others who are working people and have only 30 minutes for lunch. ...

Get Financial Accounting, IFRS Edition: 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.