Part V

Analyzing the Financial Statements

In this part . . .

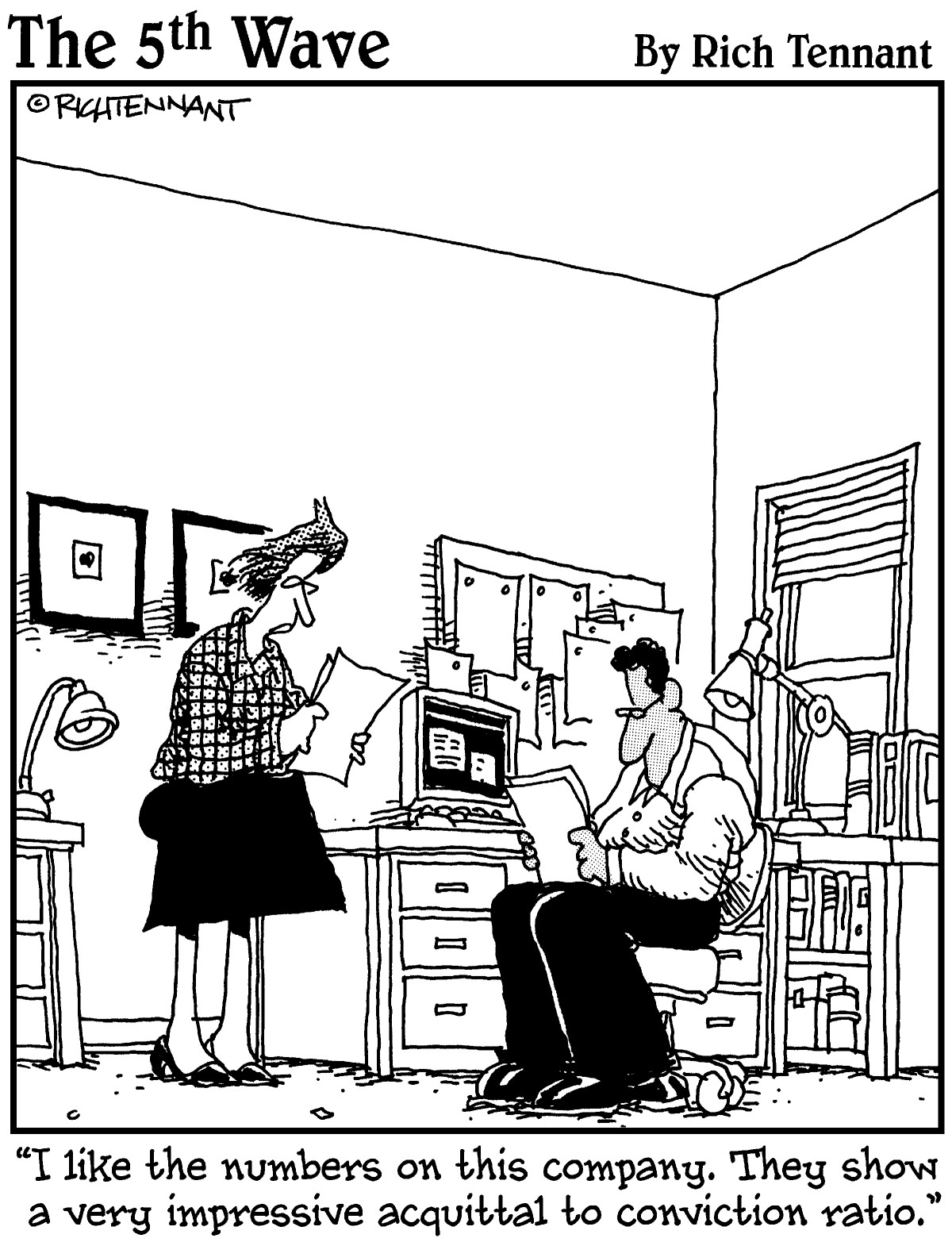

Ever wonder why financial accounting rules are so nit-picky? In this part, you see that the proper classification of accounting transactions is necessary so the users of the financial statement can accurately judge the relative merits of a company. Among the tools investors use are three financial statement measurements: liquidity, activity, and profitability. Liquidity shows how well a company can cover its short-term debt. Activity reports how well a company uses its assets to generate sales. Profitability is measured by whether the company made or lost money during the financial period.

No examination of the financial statements is complete without knowledge of the facts supporting the figures. Chapter 15 walks you through the explanatory notes and other information found in most corporate annual reports. So that you can ace this part of your financial accounting course, I walk through common explanatory notes and disclosures, such as the method of depreciation the company uses and how a company values its ending inventory.

In Chapter 16, you get the scoop on corporate annual reports and the Form 10-K, an annual report required by the U.S. Securities and Exchange Commission (SEC).