Hypothesis of Informational Efficiency of Financial Markets

Abstract

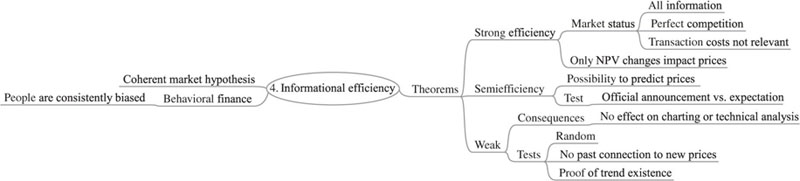

Price reflects the information available on the market. Markets are different in their abilities to process information. If the market is efficient, there is a lack of motivation for investors to process information.

Keywords

4.1. Efficient market

Get Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.