Part SixProbability Theory and Statistics

A Bayesian estimate of security beta β is obtained from its posterior distribution, which is approximately normal with mean

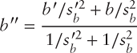

and variance

where b is the least-squares estimate of β in a linear regression, ![]() is the standard error of the estimate, and b′ and

is the standard error of the estimate, and b′ and ![]() are the mean and standard deviation, respectively, of prior information about the company's beta. In the absence of more specific knowledge about the company, the parameters of the prior distribution can be set to the mean

are the mean and standard deviation, respectively, of prior information about the company's beta. In the absence of more specific knowledge about the company, the parameters of the prior distribution can be set to the mean ![]() and standard deviation of the cross-sectional distribution of betas in the universe. (page 291)

and standard deviation of the cross-sectional distribution of betas in the universe. (page 291)

Get Finance, Economics, and Mathematics now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.