Chapter 17Probability of Loss on Loan Portfolio

Written in 1987; printed in Derivatives Pricing: The Classic Collection, P. Carr (ed.), London: Risk Books, 2004.

Consider a portfolio consisting of n loans in equal dollar amounts. Let the probability of default on any one loan be p, and assume that the values of the borrowing companies' assets are correlated with a coefficient ρ for any two companies. We wish to calculate the probability distribution of the percentage gross loss L on the portfolio, that is,

Let ![]() be the value of the i-th company's assets, described by a logarithmic Wiener process

be the value of the i-th company's assets, described by a logarithmic Wiener process

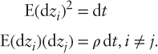

where ![]() are Wiener processes with

are Wiener processes with

The company defaults on its loan if the value of its assets drops below the contractual value of its obligations Di payable at time T. We thus have

where

and ...

Get Finance, Economics, and Mathematics now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.