Name

COUPDAYBS

Synopsis

Use COUPDAYBS (an Analysis ToolPak function) to determine the number of days between the start of the coupon period and the settlement date for a security. In order to use this function you must know the settlement date for the security, when the security matures, and the frequency of the coupon payments.

To Calculate

=COUPDAYBS(Settlement,Maturity,Frequency,Basis)

The Basis argument is the only optional

argument. The other arguments must have values.

Example

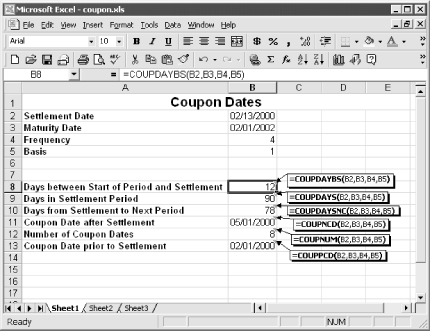

Figure 12-3 illustrates how you can determine the number of days between the start of a coupon period and the settlement date. Keep in mind that in order to use this function you must know the settlement date, maturity date, and how often the payments are made each year.

Figure 12-3. There are several different functions available for determining specific information related to coupon dates

Get Excel 2000 in a Nutshell now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.