APPENDIX K

Derivation of Asset Class Covariances

In order to develop formulas for covariance, we need to begin with formulas that relate changes in asset values to underlying fundamental factors. The covariances between asset classes will be seen to arise from the underlying fundamental factors they have in common.

Throughout this section, we use the abbreviations T, D, and E to stand for the prices of Treasury Inflation Protected Securities (TIPS), fixed-rate debt, and common equity, respectively.

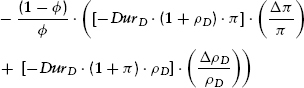

We recollect from Chapters 8 and 9 that the formulas for fixed-rate debt and TIPS change value according to these expressions:

(We have introduced subscripts to clarify that the duration term typically will have different values for fixed-rate debt versus TIPS.)

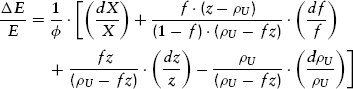

To get an expression for changes in common equity values, we substitute the expressions from (K.1) and (8.5) into equation (8.16). We end up with the next rather involved expression:

The definition of covariance between any two variables, A and B, is shown next, remembering that E(·) represents the mathematical ...