QUESTIONS

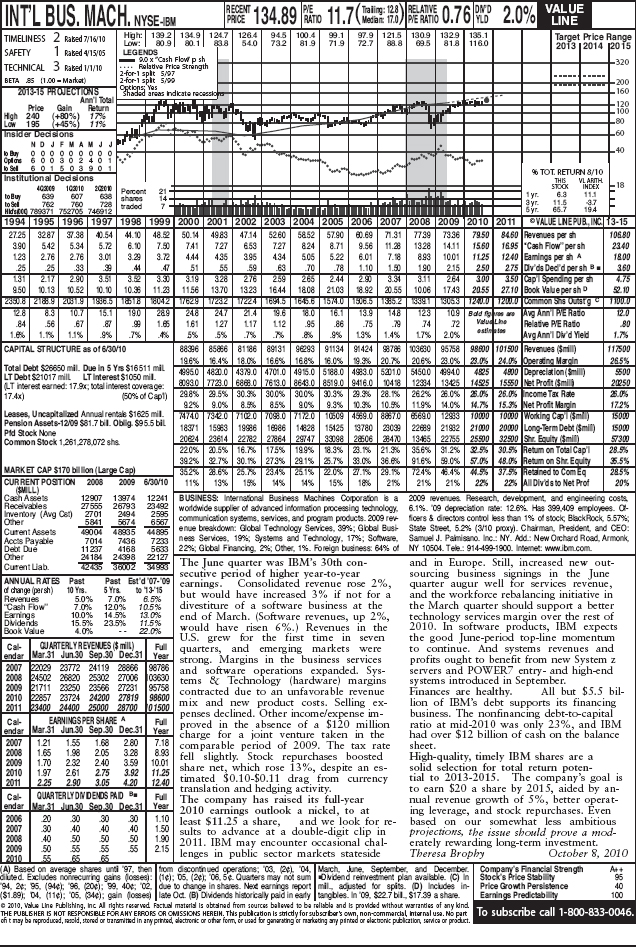

Use the Value Line report for IBM dated October 8, 2010, reproduced on the following page, to answer the questions regarding a traditional and value-based metrics analysis of this computers and peripherals company:

- What are the estimated annualized growth rates in revenue, cash flow, and earnings per share for IBM over the period 2011 to 2014? Are these rates favorable or unfavorable?

- What is the estimated ROE for IBM for 2011? Conduct a five-factor ROE Dupont analysis in answering this question. Is the estimated ROE for IBM attractive or unattractive?

- What is the fundamental stock return for IBM for 2011? Does IBM plot above or below the Securities Market Line? Assume a risk-free rate of 5% and a market risk premium of 5% in answering this question.

- What is estimated NOPAT, $WACC, and EVA of IBM for 2011? Based on the estimated EVA (economic value added), is IBM a potential wealth creator or wealth waster?

- What is the prospective EVA style quadrant of IBM for 2011? Interpret the meaning of this quadrant.

- Based on an integrated analysis of traditional and value-based metrics, do you agree with the Value Line ratings of Timeliness and Safety for IBM? Be sure to assign your own stock ratings and explain whether you think IBM is a potential buy or sell opportunity.

1 Paul M. Healy and Krishna G. Palepu, Business Analysis and Valuation: Using Financial Statements (Mason, ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.