CONSTRAINING SHORTFALL

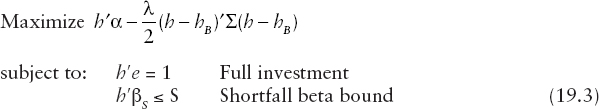

The standard active management, mean-variance optimization problem trades off risk against return. To limit the portfolio's exposure to extreme losses, we may constrain the shortfall beta of the portfolio. This is done by adding a single constraint, giving us what we will call the shortfall-constrained optimization problem:

where h are the portfolio weights, α is the vector of alphas, Σ is the covariance matrix, and λ is the risk aversion parameter. The term βS is the vector of asset-level shortfall betas (βS,i) with respect to the benchmark portfolio and S is the maximum portfolio shortfall beta permitted.6

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.