COUNTRY MEMBERSHIP AND INDIVIDUAL STOCK RETURNS

Let's start by examining the importance, in both developed and emerging markets, of country membership in determining a stock's return. In order to measure this importance, we run a series of cross-sectional regressions where the dependent variable is a stock's return in a given month and the explanatory variables are dummies for the country membership of that stock. We run these regressions each month from 1995 to 2009. A high regression R-squared means that country membership explained a lot of the cross-sectional variation in stock returns in that month. In the extreme, an R-squared of 100% indicates that every stock in a country had the same return (i.e., country membership fully determined returns in that month).

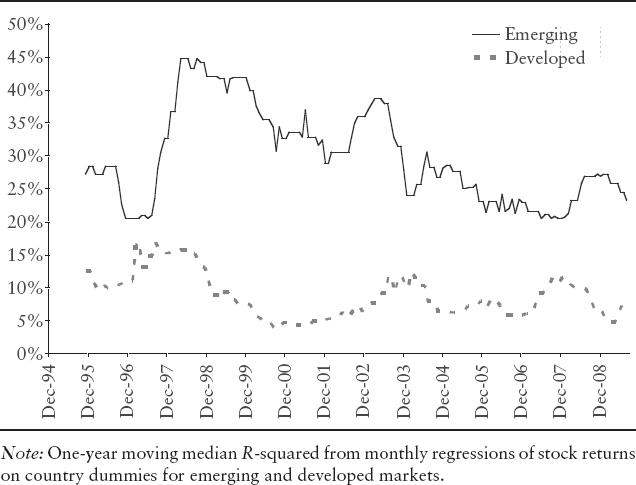

EXHIBIT 16.1 Explanatory Power of Country Membership for Monthly Stock Returns, 1995—2009

Exhibit 16.1 shows the rolling 12-month moving median R-squared from these regressions, run separately for developed and emerging markets. Country membership explained on average 11% of the cross-sectional variation of individual stock returns within developed markets. In emerging markets, the equivalent number was a remarkable 30%.2 As shown in Exhibit 16.1, the importance of country membership in emerging markets has fluctuated dramatically over time, ranging from as little as 20% to as much as 45%. Although these numbers have ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.