MODEL CONSTRUCTION METHODOLOGIES FOR A FACTOR-BASED TRADING STRATEGY

In the previous section, we analyzed the performance of each factor. The next step in building our trading strategy is to determine how to combine the factors into one model. The key aspect of building this model is to (1) determine what factors to use out of the universe of factors that we have, and (2) how to weight them.

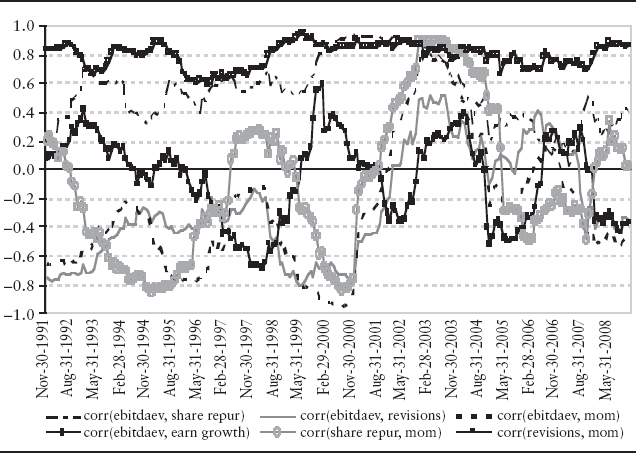

EXHIBIT 12.10 Rolling 24-Month Correlations of Monthly Returns for the Factors

We describe four methodologies to combine and weight factors to build a model for a trading strategy. These methodologies are used to translate the empirical work on factors into a working model. Most of the methodologies are flexible in their specification and there is some overlap between them. Though the list is not exhaustive, we highlight those processes frequently used by quantitative portfolio managers and researchers today. The four methodologies are the data driven, the factor model, the heuristic, and the optimization approaches.

It is important to be careful how each methodology is implemented. In particular, it is critical to balance the iterative process of finding a robust model with good forecasting ability versus finding a model that is a result of data mining.

The Data Driven Approach

A data driven approach uses statistical methods to select and weight factors in a forecasting model. This approach ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.