KEY POINTS

- A factor is a common characteristic among a group of assets. Factors should be founded on sound economic intuition, market insight, or an anomaly.

- Factors fall into three categories—macroeconomic, cross-sectional, and statistical factors.

- The main steps in the development of a factor-based trading strategy are (1) defining a trading idea or investment strategy, (2) developing factors, (3) acquiring and processing data, (4) analyzing the factors, (5) building the strategy, (6) evaluating the strategy, (7) backtesting the strategy, and (8) implementing the strategy.

- Most trading strategies are exposed to risk. The main sources of risk are fundamental risk, noise trader risk, horizon risk, model risk, implementation risk, and liquidity risk.

- Factors are often derived from company characteristics and metrics, and market data. Examples of company characteristics and metrics include valuation ratios, operating efficiency ratios, profitability ratios, and solvency ratios. Example of useful market data include analysts forecasts, prices and returns, and trading volume.

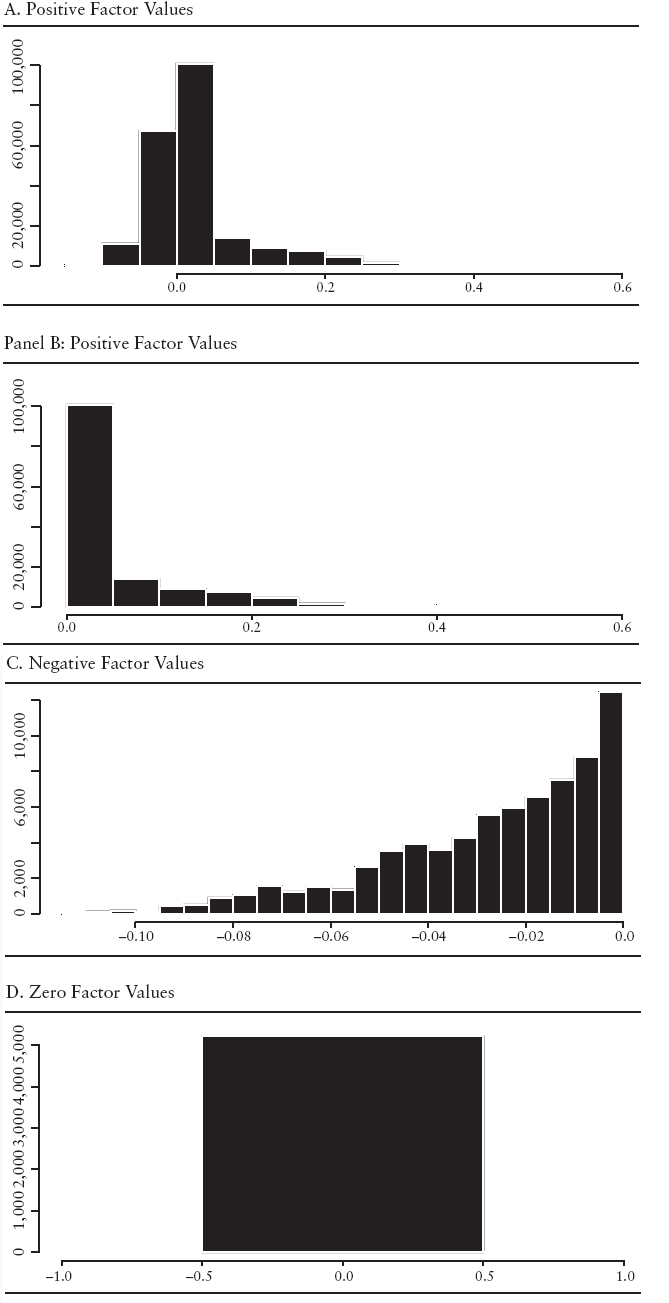

EXHIBIT 11.5 Histograms of the Cross-Sectional Values for the Share Repurchase Factor

- High-quality data are critical to the success of a trading strategy. Model output is only as good as the data used to calibrate it.

- Some common data problems and biases are backfilling and restatements of data, missing data, ...

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.