RESEARCH

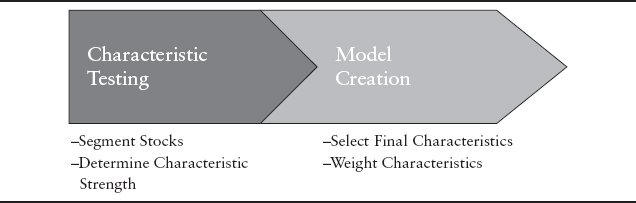

Let's start with the research phase since it is the basic building block of the quantitative process. It is where the fact-finding mission begins. This is like when the golfer spends countless hours at the driving range perfecting his (or her) swing. In this phase, the quantitative investor determines what aspects of a company make its stock attractive or unattractive. The research phase begins by the quantitative investors testing all the characteristics they have at their disposal, and finishes with assembling the chosen characteristics into a stock selection model (see Exhibit 1.7).

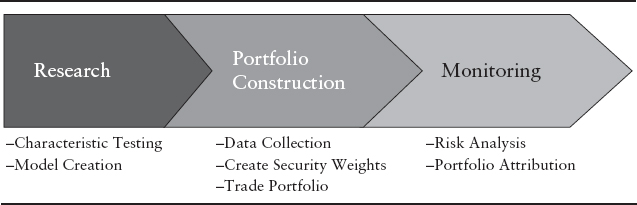

EXHIBIT 1.6 Three Core Phases of the Quantitative Equity Investment Process

EXHIBIT 1.7 Two Core Steps in the Research Phase of the Quantitative Equity Investment Process

- Characteristic testing. First, quantitative investors determine which characteristics are good at differentiating strong performing from weak performing stocks. Initially, the quantitative investor segments the stocks, this could be by sector, such as consumer discretionary, industry such as consumer electronics or a universe such as small-cap value stocks. Once the stocks have been grouped, each of the characteristics is tested to see if they can delineate the strong performing stocks from the weak performing stocks.

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.