29

Short Put Calendar Spreads

Consider the following exercise.

Exercise 29.1: Short Put Calendars

- Selling the Sep/Dec 5425 put calendar comprises two “legs”. What are they?

- What is the price of the spread?

- What views upon the underlying and volatility lie behind such a trade?

- If we sell this put calendar, where do we want the FTSE to be on Sep expiry?

- What do we not want to happen?

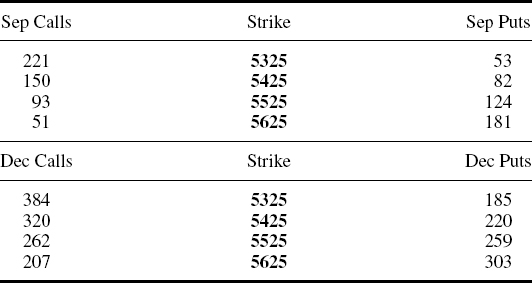

Table 29.1 LIFFE Sep and Dec FTSE 100 option prices as at close on 26 August 2008 (Sep FTSE 100 future = 5494, Dec FTSE 100 future = 5528) – repeated from Table 25.1

Exercise 29.1: Answers

- Selling the Sep/Dec 5425 put calendar comprises the following two legs; buying the (shorter-dated) Sep 5425 put and selling the (longer-dated) Dec 5425 put.

- The price of the spread is 138 ticks (equivalent to £1380), the difference between the 220 ticks received for the Dec 5425 put and the 82 ticks paid for the Sep 5425 put.

- The views behind this trade are a bullish/non-bearish view on the underlying and/or a belief that market volatility will fall.

- If we sell the Sep/Dec 5425 put calendar, we want the FTSE either to rally as far as possible or to fall as far as possible. In either event, the time value of both the Sep and Dec options will fall towards zero and we will collect the net premium received.

- Our worst-case scenario is the underlying FTSE being at exactly 5425 on Sep expiry. In this event, the Sep 5425 ...

Get Equity and Index Options Explained now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.