CHAPTER 9

FINANCING ENTREPRENEURIAL VENTURES WORLDWIDE

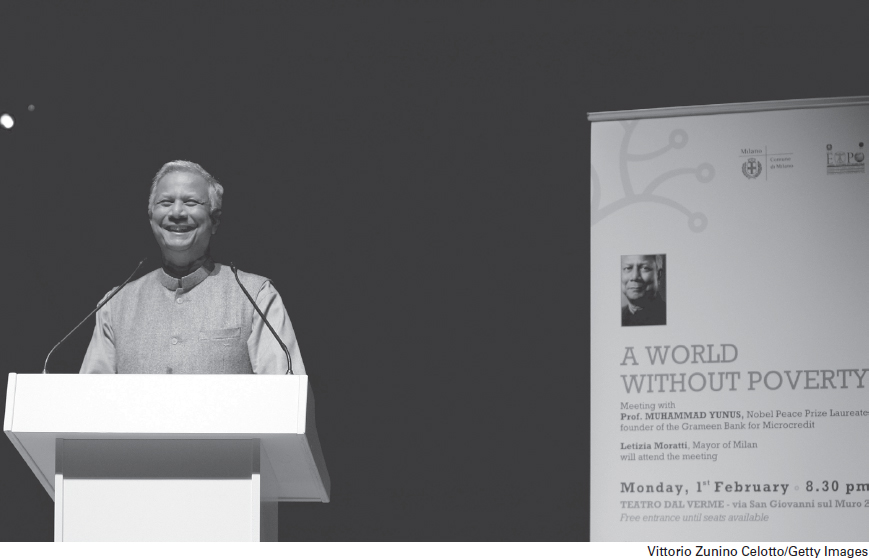

Grameen Bank Founder and Nobel Peace Prize Laureate Muhammad Yunus speaks during the lecture ‘A world without poverty’ on February 1, 2010 in Milan, Italy.

A new business searching for capital has no track record to present to potential investors and lenders. All it has is a plan—sometimes written, sometimes not—that projects its future performance. This means that it is very difficult to raise debt financing from conventional banks because they require as many as three years of actual—not projected—financial statements and assets that adequately cover the loan. Thus almost every new business raises its initial money from the founders themselves and what we call informal investors: family, friends, neighbors, work colleagues, and strangers; a few raise it from lending institutions, primarily banks; and a miniscule number raise it from venture capitalists, who are sometimes called formal investors. This chapter examines funding from entrepreneurs themselves, informal investors, and venture capitalists in the United States and throughout the world. Chapter 10 will explain how to raise equity capital, and Chapter 11 will look at nonequity sources of financing, including banks.

Before we examine conventional means of financing startups in medium- and higher-income nations, we'll begin by looking at how many would-be entrepreneurs ...

Get Entrepreneurship, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.