CHAPTER 8 Energy Portfolios

A portfolio is a collection of assets held by investors (traders, investment firms, hedge funds, financial institutions, energy market participants, corporations, governments, or individuals).

Example: One can visualize a portfolio as a pie that is partitioned into pieces of varying slices (representing a variety of assets) to achieve an appropriate risk-return portfolio allocation (Figure 8.1).

FIGURE 8.1 Energy Portfolio

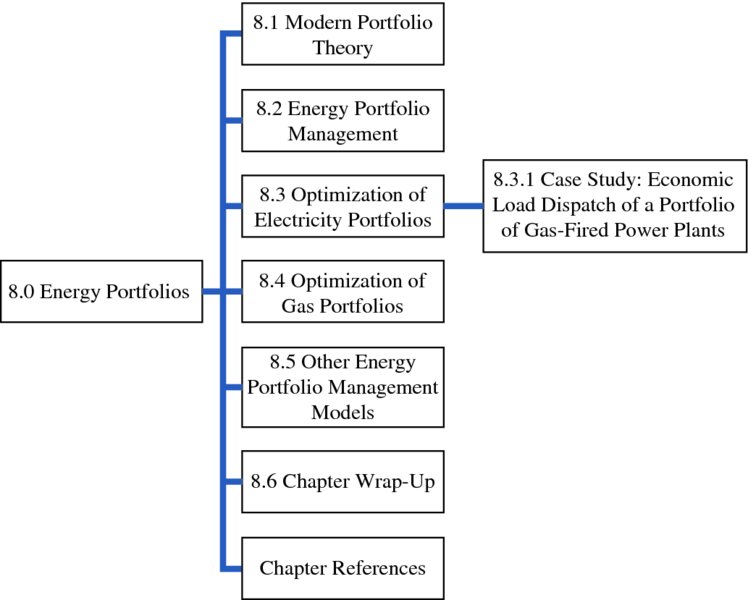

We talked a bit about portfolios when we introduced multi-asset options in Chapter 4. In this chapter we present some concepts from modern portfolio theory (MPT) and energy portfolio management (EPM). These MPT and EPM concepts are utilized to discuss optimization of electricity and gas portfolios. In addition, we discuss how MATLAB built-in functions may be utilized to optimize a portfolio of gas-fired power plants. This MATLAB case study ties together some of the concepts in this book.

8.1 MODERN PORTFOLIO THEORY

Portfolio diversification is the means by which investors

- Minimize or eliminate risks in a portfolio

- Moderate the effects of individual asset class ...

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.