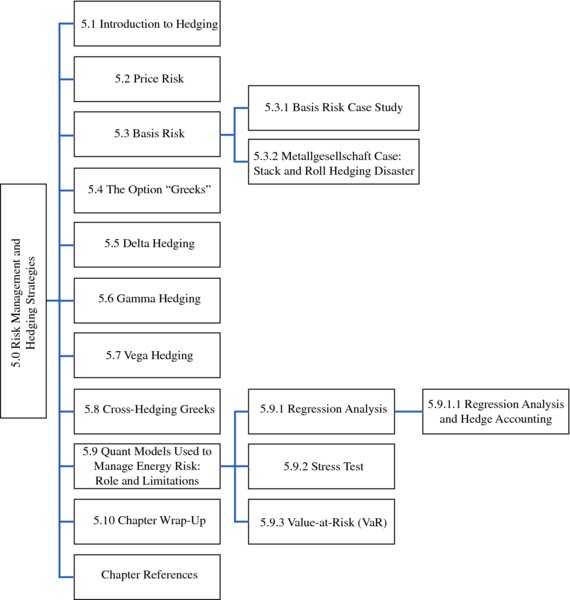

CHAPTER 5 Risk Management and Hedging Strategies

The relationship between risk and return is a fundamental concept in finance. Risk includes the possibility that an investor or trader may lose some or all of its original investment. Risk management is the process of identification, analysis, and either acceptance or mitigation of uncertainty in investment decision making. In addition, risk management may be viewed as the immunization of a portfolio against risk.

As we will discuss in Section 5.4, the Greeks measure the sensitivity of the value of a portfolio to small changes in various parameters. These Greeks

- Provide important information for risk management

- Are useful for energy market participants who seek to “hedge” their portfolios from adverse changes in market conditions

Note: We will define a hedge in Section 5.1.

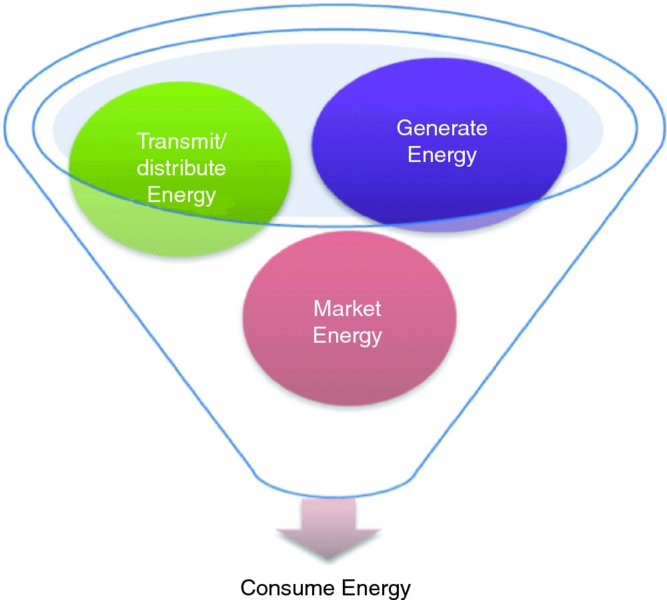

Participants in the energy markets perform one or more of the following functions:

In Table 5.1 we list five general types of business risks incurred by energy market participants. A more detailed breakdown of these risks may be found in Figure 5.1. In addition, some risks ...

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.