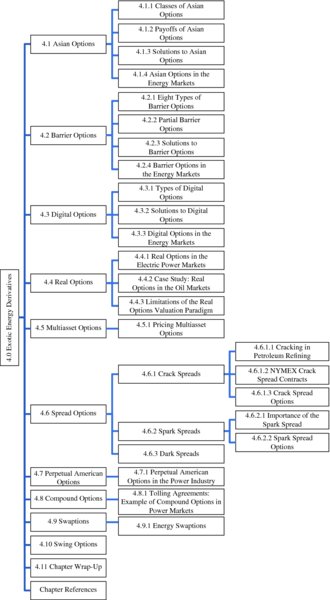

CHAPTER 4 Exotic Energy Derivatives

In the previous chapter we discussed plain vanilla energy derivatives. In this chapter we will discuss the various types of exotic energy derivatives listed in Table 3.2. Recall that an exotic derivative was defined to be any of a broad category of derivatives that may include complex financial structures. A more detailed definition of exotic derivatives—from Section C (10) of Annex 1 to the Markets in Financial Instruments Directive (MiFID)—is as follows:

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates, emission allowances or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties (otherwise than by reason of a default or other termination event), as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this Section, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market or a multilateral trading facility (MTF), are cleared and settled through recognized clearing houses or are subject to regular margin call. (Pointon 2006; Wasenden 2012)

Exotic derivatives have more complex features than commonly traded ...

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.