CHAPTER 20Financial Accounting Entries

In Chapter 4 we established how to recognize and measure financial assets and liabilities in the trading books. We now need to understand what financial accounting entries are required so that we adhere to IAS 39 and IFRS 9. In this chapter, we will look at financial accounting entries for financial instruments, a typical chart of accounts and the role of an accounting rules engine.

Financial Accounting Entries

Financial accounting is a double entry system which stipulates that whenever there is a debit entry there also needs to be a corresponding credit entry and vice versa. Debits and credits have the following impact on the financials:

- P&L and equity accounts are debited for losses and credited for profits.

- Balance sheet accounts, conversely, are debited for assets and credited for liabilities.

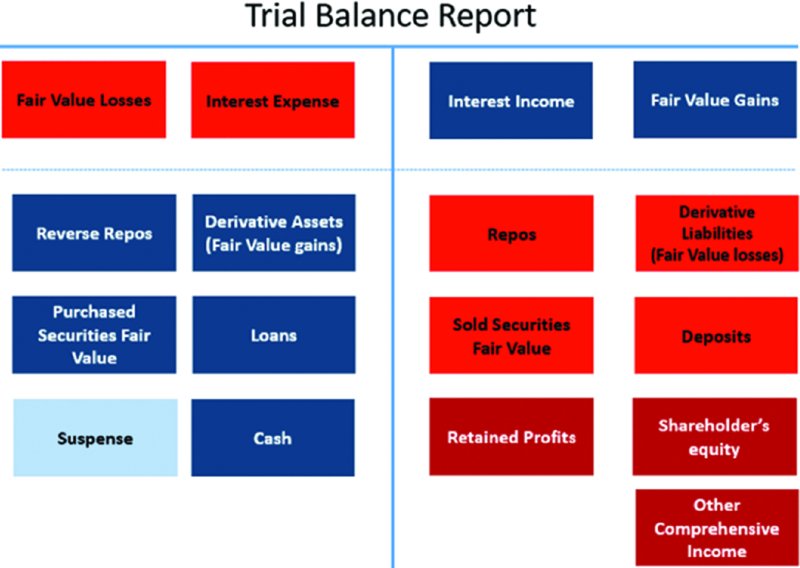

Figure 20.1 illustrates a typical trial balance report for a bank. In the top section you have the profit and loss entries where fair value losses and interest expenses are recorded as debits on the left-hand side whilst fair value gains and interest income are reported as credits on the right-hand side.

Figure 20.1 A trial balance report

Below the dotted line we have those amounts which make up the balance sheet and statement of equity. On the left-hand side, we represent our assets as debits and on the right-hand side we represent our ...

Get Effective Product Control now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.