CHAPTER 10Review of Mark-to-Market P&L

In the previous chapter we reviewed the controls over trading activity. We will now move on to look at those controls which validate the profit and loss (P&L) generated from existing positions, which is known as mark-to-market (MTM) or market moves P&L.

This chapter does not apply to portfolios which are accounted for on an amortized cost basis.

Defining Mark-to-Market P&L

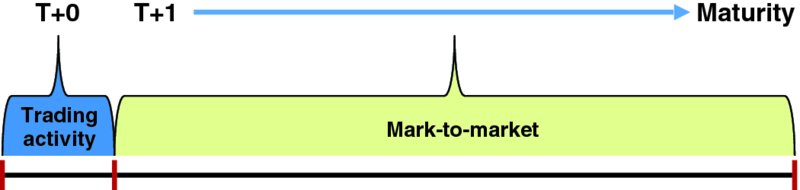

When the desk executes a new trade, the P&L generated on day one is ring-fenced and reported as new trade P&L. From T+1 until maturity, the P&L generated will be reported as MTM P&L. This is illustrated in Figure 10.1.

Figure 10.1 Defining MTM P&L

It is important that we ring-fence the MTM P&L as:

- Market risk rely upon an untainted MTM P&L to perform their VaR back testing.

- It enables a comparison back to a risk-based P&L estimate.

- It enables the desk to compare the MTM P&L in their estimate to product control's view.

- The Volcker rule requires MTM P&L to be reported separately.

- It informs the firm's senior management and regulators how much of the bank's P&L is attributable to risk-taking.

Product control employ several methods to validate the MTM P&L (Figure 10.2). These methods include:

- Attributing the MTM P&L to its underlying drivers

- Performing a risk-based P&L estimate

- Understanding price changes in the financial markets.

Figure 10.2 Validating MTM P&L ...

Get Effective Product Control now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.