CHAPTER 9Review of New and Amended Trades

The review of new and amended trades forms a key part of the control framework within a bank. This chapter will look at why these controls are necessary and examine how they are executed.

New Trades

Why New Trades Are Generated

Each day the sales and trading desks accept client orders and trades in the market to generate profits and hedge risk for their bank (Figure 9.1).

Figure 9.1 Drivers of new trades

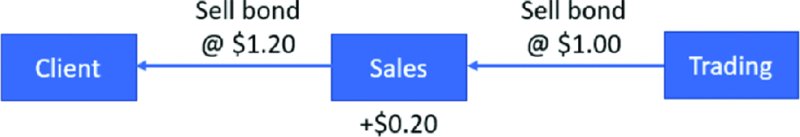

When a client trades with a bank, the bank's sales desk will earn a fee that is usually included in the trade price rather than as an explicit payment. This fee is known internally within the bank as margin, spread, edge or sales credits. In Figure 9.2 the sales desk has earned a margin of $0.20 by purchasing a bond at $1.00 from the trading desk and selling it on to the client for $1.20.

Figure 9.2 Drivers of new trades

Note: You will not always see a separate trade between sales and trading. This is more commonly seen for FX trading and when selling to clients through a subsidiary

The sales desk will attempt to make as much margin as possible without being so large that the client withdraws its business from the bank (banks will maintain policies regarding this). As margins earned on a vanilla trade will typically be consistent ...

Get Effective Product Control now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.