CHAPTER 5Market Risk

Market risk is an important technical skill which a product controller requires to be effective in their role. This chapter will highlight what market risk is, how a bank measures it and what interaction product control have with market risk.

What Is Market Risk and How Is It Generated?

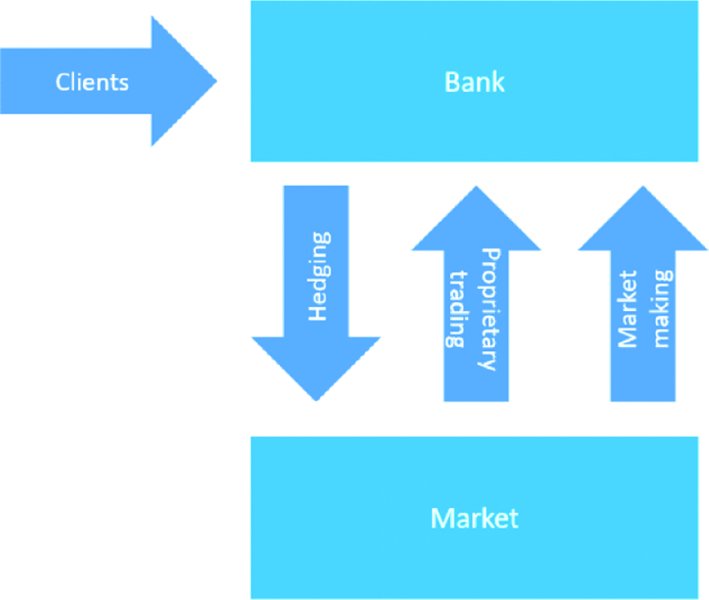

Market risk is the risk that the desk's portfolio will rise or fall in value due to changes in market prices, which can lead to either profits or losses for the bank. Market risk is generated whenever the desk hold a position in a financial instrument, which could have originally been driven by a client wanting to execute a trade, the desk engaging in proprietary trading or the desk making markets in a financial instrument. The desk can mitigate market risk through hedging their risk exposures either fully or partially. As market risk is not static (i.e., it can change throughout the trading day), the desk need to rebalance their portfolio on an ongoing basis to maintain their desired risk exposure.

Figure 5.1 illustrates the generation of market risk via the arrows leading into the bank and the mitigation of risk via the arrows leading away from the bank.

Figure 5.1 Generating and laying off market risk

When a client trades with the bank, they are usually hedging their own risk and passing that risk on to the bank. The bank can then choose to hedge that risk, by passing ...

Get Effective Product Control now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.