Chapter 17 How to Manage a Market Crash

“Never bet on the end of the world. It only happens once.”

—Art Cashin

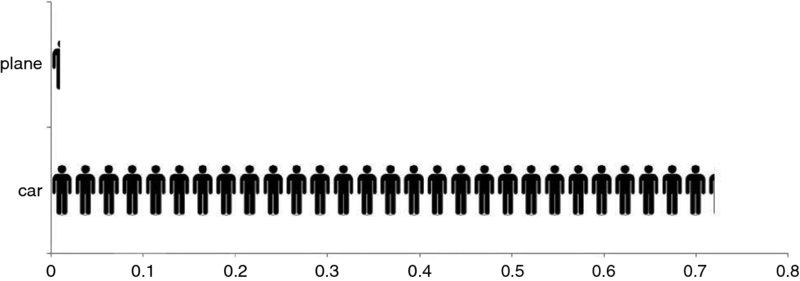

One reason to avoid the stock market is that it could crash overnight. Scary thought, no? In a similar way to plane crashes, market crashes are vivid events that scare us more than they should, statistically speaking, just as the drive to the airport is riskier than the flight. Figure 17.1 is an illustration of just how safe flying is compared to car travel. Fear and risk are quite different things.

Figure 17.1 Deaths per 100 Million Miles Traveled—Car vs. Plane

In a similar manner, staying in cash, rather than being in stocks, can prove more costly to the growth of your savings than investing. Once again, the part of the human brain that was perfected to helping us avoid getting eaten by a tiger entices us to be scared into making poor financial decisions. We worry excessively about the big and scary—but unlikely—events, and this bias means that we end up overlooking the more mundane realities. The Standard & Poor’s (S&P) 500 has fallen over 10 percent on 13 separate occasions in the past 70 years since the Second World War. That’s roughly once every 6 years, but it’s important to remember that on each occasions the market has come back to make new highs. In retrospect, that makes these declines look more like buying opportunities than risks for your investing ...

Get Digital Wealth now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.