Chapter 13 The Greatest Mistakes Made by Novice Investors

“The investor’s chief problem—even his worst enemy—is likely to be himself.”

—Benjamin Graham

Some of the biggest mistakes made by novice investors stem from the fact that the value of the Standard & Poor’s (S&P) 500 is one of the most widely reported numbers by the media. This focuses attention on pretax returns within the United States. There are two problems with that. The first is that tax is a big deal in investing and something you can control fairly easily with some simple steps. The second is that the focus on the U.S. market means that many investors are not as diversified as they should be. Here are some quick tips to make sure that your portfolio doesn’t have any major flaws.

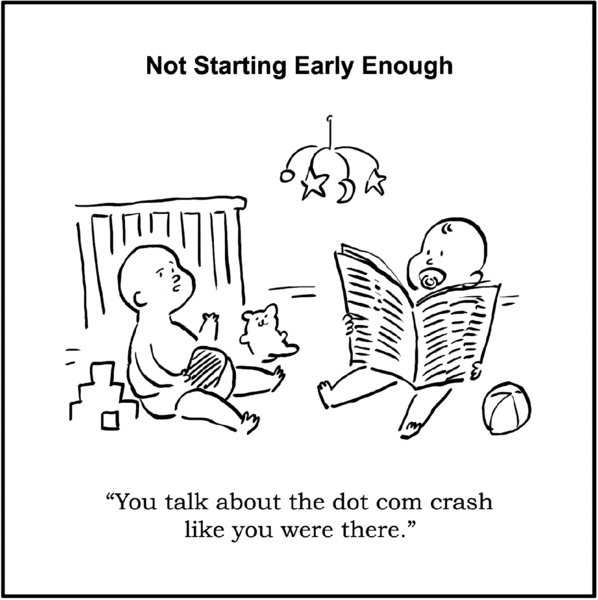

Starting Saving Too Late

One of the most important numbers for your investment strategy is your savings rate. As discussed in Chapter 1, that number is too low for many American households. However, starting saving as soon as you can is critically important, too. Not only does it increase the amount of your savings, but it also gives your money more time to grow due to the logic of compounding—it helps your money make money. Digital advisors are helpful in this regard, in that you are able to start saving with low minimums, typically just several thousand dollars, so there’s no barrier to getting started for most people.

Source ...

Get Digital Wealth now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.