Chapter 1 America’s Savings Challenge

“The best time to plant a tree was 20 years ago; the second best time is now.”

—Chinese Proverb

We Don’t Save Enough

As many an NFL star can attest, it can be easy to have wealth in the short term but not keep it for the long term by spending beyond your long-term means. This problem plays out across U.S. society. The allure of advertising and broad availability of debt don’t help. It can lead to a bias toward spending, rather than saving, to try and keep up with the neighbors. This often comes at the expense of long-term security.

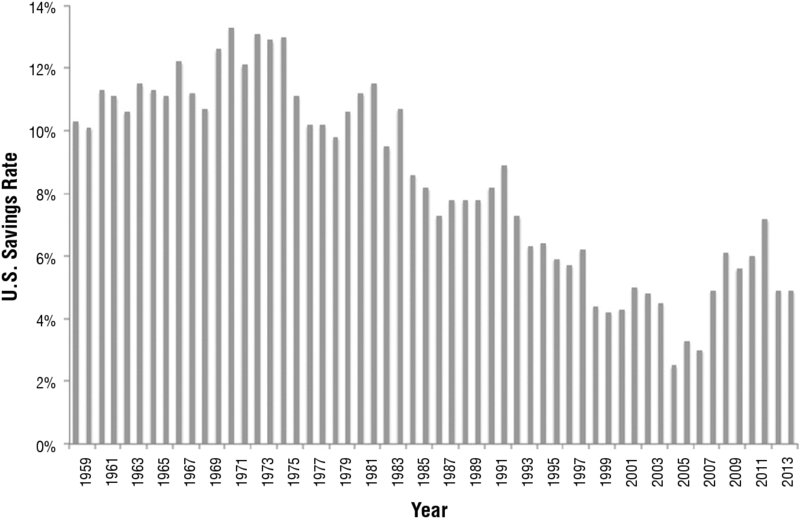

Unfortunately, the numbers for savings rates in the United States are poor relative to both history and other countries. As you can see from Figure 1.1, up until the 1980s, the U.S. savings rate was comfortably around 10 percent. Since the 1980s, the savings rate has fallen and now trends around 5 percent. Recessions generally cause the savings rate to spike, but the long-term trend in the United States is clear. The savings rate has basically halved.

Figure 1.1 US Personal Savings Rate

Source: US. Bureau of Economic Analysis

This rate is lower than all but a handful of developed countries. Of course, adjustments need to be made for demographics and the degree of “safety net” that a government offers to replace the need for saving for emergencies such as unemployment or healthcare costs. However, even ...

Get Digital Wealth now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.