4.1. STRUCTURE OF DISCOUNTED CASH FLOW VALUATION

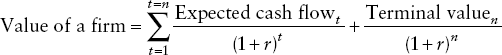

To value an asset, we have to forecast the expected cash flows over its life. This can become a problem when valuing a publicly traded firm, which at least in theory can have a perpetual life. In discounted cash flow (DCF) models, we usually resolve this problem by estimating cash flows for a period (usually specified to be an extraordinary growth period) and a terminal value at the end of the period. While we will look at alternative approaches, the most consistent way of estimating terminal value in a discounted cash flow model is to assume that cash flows will grow at a stable growth rate that can be sustained forever after the terminal year. In general terms, the value of a firm that expects to sustain extraordinary growth for n years can be written as:

In keeping with the distinction between valuing equity and valuing the business that we made in the previous chapters, we can value equity in a firm by discounting expected cash flows to equity and the terminal value of equity at the cost of equity or we can value the entire firm by discounting expected cash flows to the firm and the terminal value of the firm at the cost of capital.

There are three components to forecasting cash flows. The first is to determine the length of the extraordinary growth period; different firms, depending on where they stand in their life cycles ...

Get Damodaran on Valuation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.