12.4. INTANGIBLE ASSETS WITH POTENTIAL FUTURE CASH FLOWS

The most difficult intangible assets to value are those that have the potential to create cash flows in the future but do not produce them right now. While these assets are difficult to value on a discounted cash flow valuation basis and often impossible to evaluate on a relative basis, they do have option characteristics and are best valued using option pricing models. In this section, we begin by looking at undeveloped patents and natural resource reserves as options and then move on to consider two less clearly defined intangible assets—the option to expand into new markets and products and the option to abandon investments. (Appendix 12.1 provides a short overview of option pricing models.)

12.4.1. Undeveloped Patents

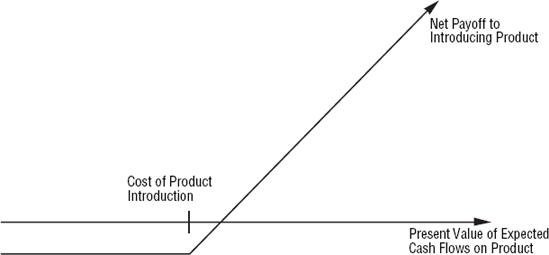

A patent provides a firm with the right to develop and market a product or service and thus can be viewed as an option. While an undeveloped patent may not be financially viable today and generate cash flows, it can still have considerable value to the firm owning it because it can be developed in the future. In this section, we consider first the mechanics of estimating the value of a patent as an option and then expand the discussion to consider how best to value a firm with both developed products and undeveloped patents.

Figure 12.1. Payoff to Introducing Product Patent as Option

12.4.1.1. Valuing ...

Get Damodaran on Valuation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.