3.5. FROM FIRM TO EQUITY CASH FLOWS

Whereas cash flows to the firm measure cash flows to all claim holders in the business, cash flows to equity focus only on cash flows received by equity investors in that business. Consequently, they require estimates of cash flows to lenders and other nonequity claim holders in the business. In the narrowest sense, the only cash flow that equity investors receive from the firm is dividends, and we can build our valuations around dividends paid. As we will see in this section, firms do not always pay out what they can afford to in dividends. A more realistic estimate of equity value may require us to estimate the potential dividends—the cash flow that could have been paid out as a dividend.

3.5.1. Dividends

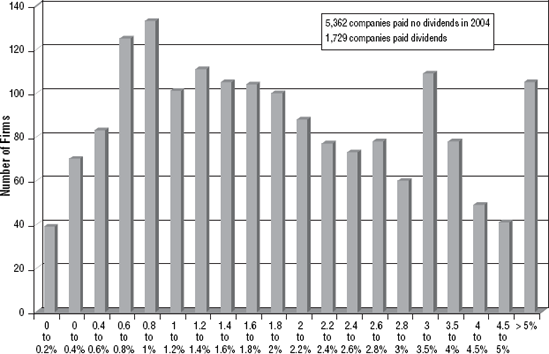

Stockholders in many publicly traded firms receive dividends on their stock. These dividends can range from zero to paltry to substantial. One simple measure of how much return stockholders can expect to generate from dividends is the dividend yield, which is defined to be the dividends per share as a percent of the market price. Figure 3.3 summarizes dividend yields for dividend-paying stocks in the United States in January 2005.

Figure 3.3. Dividend Yields: U.S. Companies in January 2005

The median dividend yield for dividend-paying stocks is slightly lower than 2 percent, and the average dividend yield is about 2.4 percent. The reason ...

Get Damodaran on Valuation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.