CHAPTER 6

Relationship between Risk and the Cost of Capital

How Risk Affects the Cost of Capital

Valuation of Risky Net Cash Flows

Risk Aversion versus Risk Neutrality

Market Returns Increase as Risk Increases by Asset Class

Liquidity and Marketability Risk

Measuring Riskiness of Net Cash Flows

ASC 820 Fair Value Measurement: Cash Flows and Present Value Discount Rates

INTRODUCTION

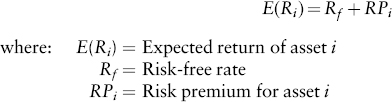

The cost of capital for any given investment can be expressed as a combination of two basic factors:

- Risk-free rate. By “risk-free rate,” we mean a rate of return that is available in the market on an investment that is free of default risk, usually the yield to maturity on a U.S. government security. It is a “nominal” rate (i.e., it includes expected inflation).

- Premium for risk. This is an expected amount of return over and above the risk-free rate to compensate the investor for accepting risk (e.g., risk of amount and timing of net cash flows or the risk of illiquidity).

The generalized cost of capital relationship is:

(Formula 6.1)

Quantifying the amount by which risk affects the cost of capital for any particular business or investment is arguably one of the most difficult analyses in the field of corporate finance, including valuation and capital budgeting, and rate making for utilities. Estimating ...

Get Cost of Capital: Applications and Examples, + Website, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.