CHAPTER 9

FINANCIAL STATEMENT ANALYSIS

SOLUTIONS

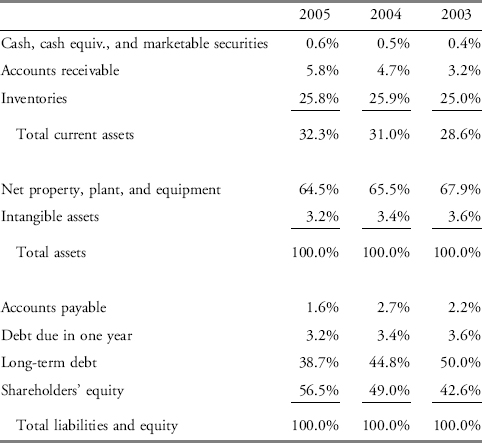

1. C is correct. To address this question, we need to first calculate the common-size percentages for the balance sheets in 2003 through 2005.

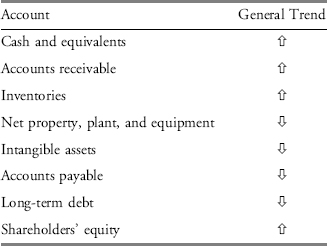

Once we have these percentages, we can see the changing composition of the balance sheet over time:

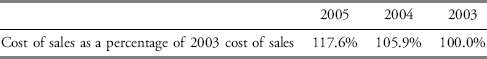

2. B is correct.

3. B is correct.

4. B is correct. The most significant benefit of using common-size statements is scaling, whether for a given company or over time. Common-size analysis allows us to make comparisons of investments, financing, and profitability between companies of different sizes and over time for a single company.

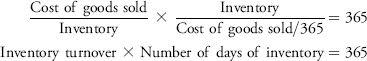

5. B is correct. We perform the calculations using the following relationship:

Inserting the given information, we have

![]()

and solving for inventory turnover provides a turnover of 7.3 times.

6. B is correct. Compare the formulas for the operating cycle and the net ...