CHAPTER 4

MEASURES OF LEVERAGE

SOLUTIONS

1. C is correct. The companies’ degree of operating leverage should be the same, consistent with C. Sales risk refers to the uncertainty of the number of units produced and sold and the price at which units are sold. Business risk is the joint effect of sales risk and operating risk.

2. C is correct. The degree of operating leverage is the elasticity of operating earnings with respect to the number of units produced and sold. As an elasticity, the degree of operating leverage measures the sensitivity of operating earnings to a change in the number of units produced and sold.

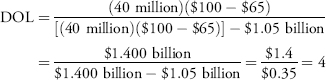

3. C is correct. Because DOL is 4, if unit sales increase by 5%, Fulcrum’s operating earnings are expected to increase by 4×5%=20%. The calculation for DOL is:

4. C is correct. Business risk reflects operating leverage and factors that affect sales (such as those given).

5. B is correct. Grundlegend’s degree of operating leverage is the same as Basic Company’s, whereas Grundlegend’s degree of total leverage and degree of financial leverage are higher.

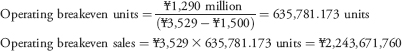

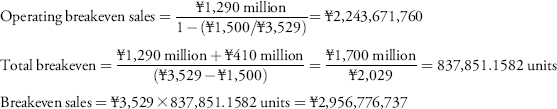

6. B is correct.

or

or

7. A is correct. For The Gearing Company,

For Hebelkraft, Inc.,

8. C is correct. Sales ...