Chapter 38

DISTRIBUTION IN PRACTICE: DIVIDENDS AND SHARE BUY-BACKS

Now, give the money back

The topics addressed in this chapter are the logical complement of the preceding chapter. Distribution of cash can take the form of ordinary dividend payments, but also of exceptional dividends, share buy-backs or capital reductions.

Section 38.1

DIVIDENDS

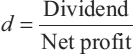

1/ PAYOUT RATIO AND DIVIDEND GROWTH RATE

- In practice, when dividends are paid, the two key criteria are:

- the rate of growth of dividends per share;

- the payout ratio (d), represented by

All other criteria are irrelevant, frequently inaccurate and possibly misleading. For example, it is absurd to take the ratio of the dividend to the par value of the share, since par value often has little to do with equity value.

Hence the difficulty for a company of meeting a dividend yield objective. It is the shareholder who, when evaluating the company, determines the desired yield, not the other way round.

In this regard, numerous tests have been performed to show that investors systematically re-evaluate a company when the amount of the dividend is made public.

In Europe, a payout ratio lower than 20% is considered to be a low dividend policy, whereas one greater than 60% is deemed high. The average in 2008 was about 40%.

In 2010, only 62 out ...

Get Corporate Finance Theory and Practice, Third Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.