Introduction: Contrasts, Shocks, Threats and Opportunities

It's been a very long time indeed since we've seen such a contrast between macro-economics and company performances. We won't dwell on the macro-economics in order to avoid getting too depressed – something we're not used to at the Vernimmen. Suffice it to say, we have budget deficits that remain high at over 7% of GDP in many countries (and 10% in the USA), inflation that seems to be rising, high unemployment, economic depression in the so-called peripheral European countries (Greece, Ireland, Portugal), questions over the viability of the euro zone, persistence of monetary and trade imbalances, etc.

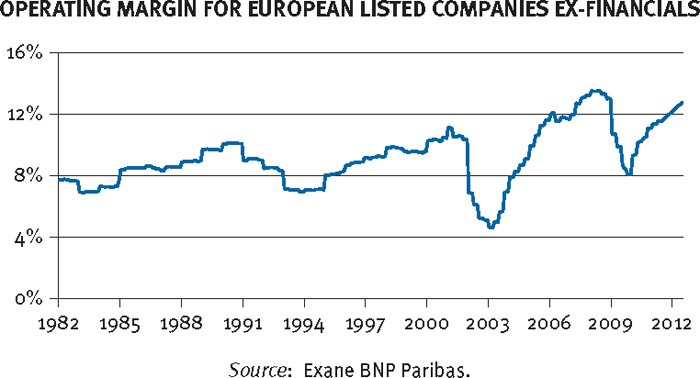

Alongside, and despite, the above, we have companies that have rarely been in such good health. In 2011, European companies listed on stock exchanges and, accordingly, examples of good companies could generate operating margins close to the historic high of over 11%:

They have continued to deleverage. With an average Debt/EBITDA ratio of 1.2 times1 we can't say that the situation is unhealthy, all the more so since most debt is concentrated on LBOs, diversified Spanish public works groups and real estate companies where lending is based on the value of assets and not on the basis of EBITDA.

At a European level, the situation for SMEs with over 20 employees is not very different, as most of them have a share of over 30% of equity ...

Get Corporate Finance Theory and Practice, Third Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.