Chapter 3

Basic Principles of Central Clearing

[CCPs] emerged gradually and slowly as a result of experience and experimentation.

Randall Kroszner (1962–)

3.1 WHAT IS CLEARING?

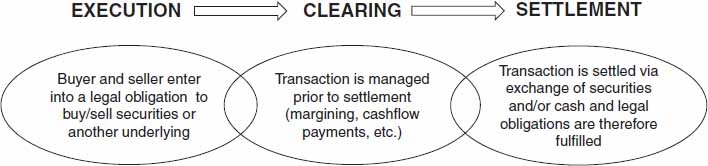

Broadly speaking, clearing represents the period between execution and settlement of a transaction, as illustrated in Figure 3.1. At trade execution, parties agree to legal obligations in relation to buying or selling certain underlying securities or exchanging cashflows in reference to underlying market variables. Settlement refers to the completion of all such legal obligations and can occur when all payments have been successfully made or alternatively when the contract is closed out (e.g. offset against another position). Clearing refers to the process between execution and settlement, which in the case of classically cleared products is often a few days (e.g. a spot equity transaction) or at most a few months (e.g. futures or options contracts). For OTC derivatives, the time horizon for the clearing process is more commonly years and often even decades. This is one reason why OTC clearing has such importance in the future as more OTC products become subject to central clearing.

Figure 3.1 Illustration of the role of clearing in financial transactions.

Broadly speaking, clearing can be either bilateral or central. In the former case, the two parties entering a trade take responsibility (potentially ...

Get Central Counterparties: Mandatory Central Clearing and Initial Margin Requirements for OTC Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.