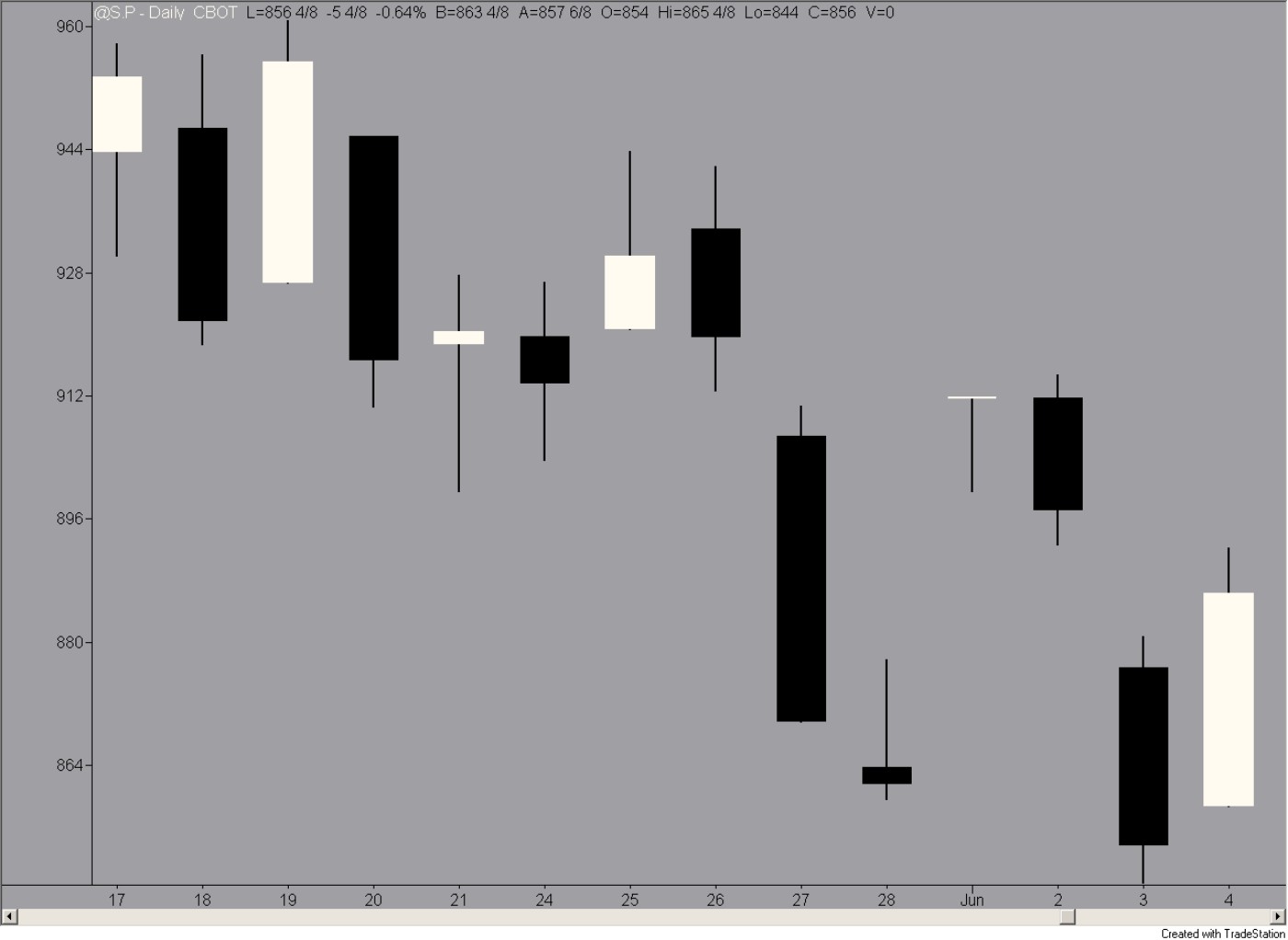

The Bearish Long Black Candle

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. It’s a long candlestick compared to other candlesticks on the same chart, and most or all of it is made up by a solid candle.

|

Figure 5-13: A dragonfly doji not working out too well. |

|

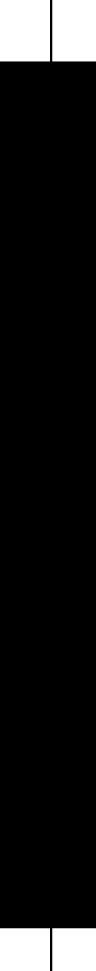

Understanding long black candles

A long black candle is created when the bears seize control at the start of a day and push until the day’s end. Figure 5-14 is a picture of a typical long black candle.

|

Figure 5-14: A long black candle. |

|

For some quick insight on the numbers involved, have a look at Figure 5-15, which is an intraday chart of price action that creates a long black ...

Get Candlestick Charting For Dummies® now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.