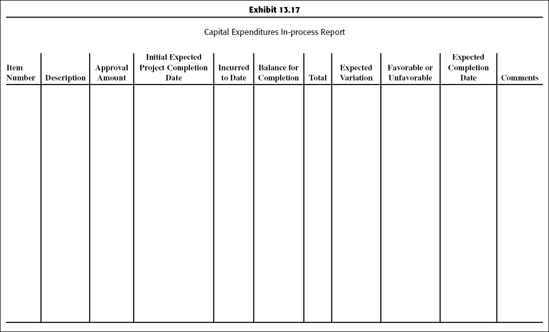

13.5. Capital Expenditure Reports

The capital expenditure report should contain information of the authorized amount, actual costs, committed funds, unencumbered balance, estimated cost to complete, and cost overrun (underrun).

Exhibit 13.17 presents a capital expenditures process report.

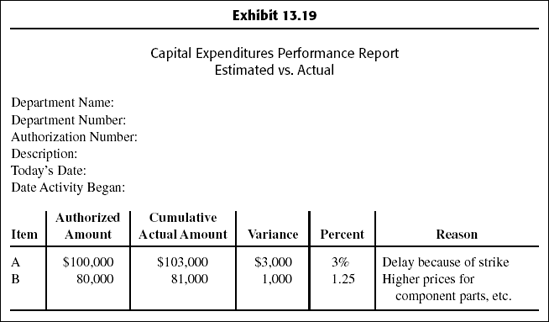

Exhibits 13.18 and 13.19 present typical reports showing the comparison of budgeted expenditures to actual expenditures.

Exhibit 13.20 presents a capital expenditure status report. This report should be prepared periodically by the manager to keep track of a project so that analysis and control may be facilitated.

A progress report should be prepared to determine if all is going as planned and what corrective action is needed, if any. A detailed evaluation of capital expenditures may not be possible when a sudden, unexpected, or important development occurs. An example is a machine breakdown resulting in a production delay on the assembly line.

A capital expenditures progress report monitors each project's progress and indicates any overruns or underruns. Exhibits 13.21 to 13.26 present representative reports.

Get Budgeting Basics and Beyond now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.