12.1. Budget Process

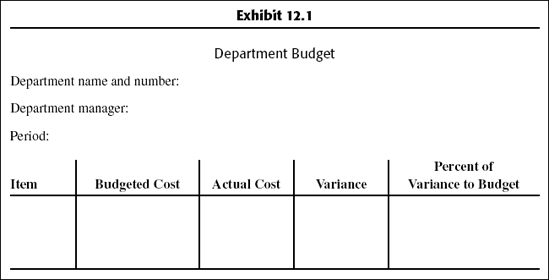

The manager may budget general and administrative expenses based on specific plans and programs. Because most administrative expenses are fixed, an analysis of the historical record typically will provide a sound basis to budget them. The variable-fixed breakdown is highly recommended.

The budgeting of administrative expenses is difficult to plan and control. One approach is to establish acceptable ranges of costs as percentages of revenue to achieve target earnings. Another is to review administrative costs and determine how much should be allocated to each area by using historical data.

It is worthwhile to break general and administrative expenses into discretionary and nondiscretionary costs. Discretionary costs, such as bonuses, are those that are not essential to satisfy short-term business goals. These costs are usually targets for cutting when costs need to be reduced.

The manager may budget rent simply by using the monthly rent figure. This figure should include an adjustment for cost of living increases, property taxes, and rent escalation clauses.

In budgeting salaries, multiply the number of employees by their monthly salaries. There should be included a provision for salary increase, sick leave time, vacation, holidays, and fringe benefits.

In budgeting taxes and licenses, use a historical percentage rate. Research city, state, and federal sources ...

Get Budgeting Basics and Beyond now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.