15

BOND FUTURES

Bond futures contracts allow market participants to agree to buy or sell bonds at delivery dates in the future. Investors who are long in bond futures are able to lock-in future lending interest rates. Investors taking short positions in bond futures are able to lock-in future borrowing interest rates.

This chapter concentrates on Treasury bond futures contracts because these are widely traded. In addition to Treasury bond futures contracts, several contracts on Treasury note futures are traded in the United States. Bond futures contracts are also traded in England, Germany, and Japan. The mechanics of these other contracts are very similar to Treasury bond futures and the analysis can be easily adapted to handle these other futures contracts.

Treasury Bond Futures

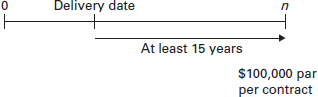

The Chicago Board of Trade (CBT) has a US Treasury bond futures contract calling for the delivery of $100,000 par value of Treasury bonds with at least 15 years to maturity or first call date, whichever is sooner. Figure 15.1 illustrates the contract.

Figure 15.1 Treasury bond futures

For a number of years, this so-called T-bond futures contract has been one of the most actively traded futures contracts. This contract is extremely attractive as a hedging tool to bond dealers, underwriters, banks, and other financial institutions.

Treasury bond futures are quoted per $100 of par value in 1/32 of a dollar. ...

Get Bonds and Bond Derivatives, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.