Chapter 6: Duration and Convexity

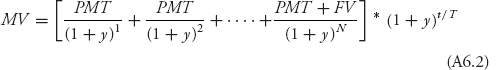

Equation 6.1 is the general bond pricing relationship between coupon payment dates. MV is the total price including accrued interest; PMT is the periodic coupon payment; FV is the principal redeemed in N periods as of the beginning of the current period, and t/T of the period has gone by and 1 – t/T remains.

![]()

Multiply the numerator and denominator on the right side by (1 + y)t/T.

Define the term in brackets to be PV, the price of the bond if the yield y prevailed at the beginning of the period when there were

Get BOND MATH: The Theory Behind the Formulas now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.